The recent layoffs at Charles Schwab have sent ripples through the financial industry, raising questions about the company’s future, the reasons behind these decisions, and their broader economic implications. This comprehensive analysis delves into the multifaceted aspects of the Schwab layoffs, providing insights backed by case studies, examples, and data. Whether you’re an investor, a financial professional, or simply someone interested in the financial sector, this article aims to provide a thorough understanding of the situation.

Introduction

The term “Schwab layoffs” has been a trending topic in the financial news recently, reflecting significant changes within one of the largest brokerage firms in the United States. This article aims to provide a detailed exploration of these layoffs, examining the reasons behind them, their impact on the company, and the broader economic consequences.

Background of Charles Schwab

Company History

Founded in 1971 by Charles R. Schwab, the company revolutionized the brokerage industry with its low-cost, customer-centric approach. Over the years, Schwab has grown exponentially, expanding its services to include banking, asset management, and financial advisory.

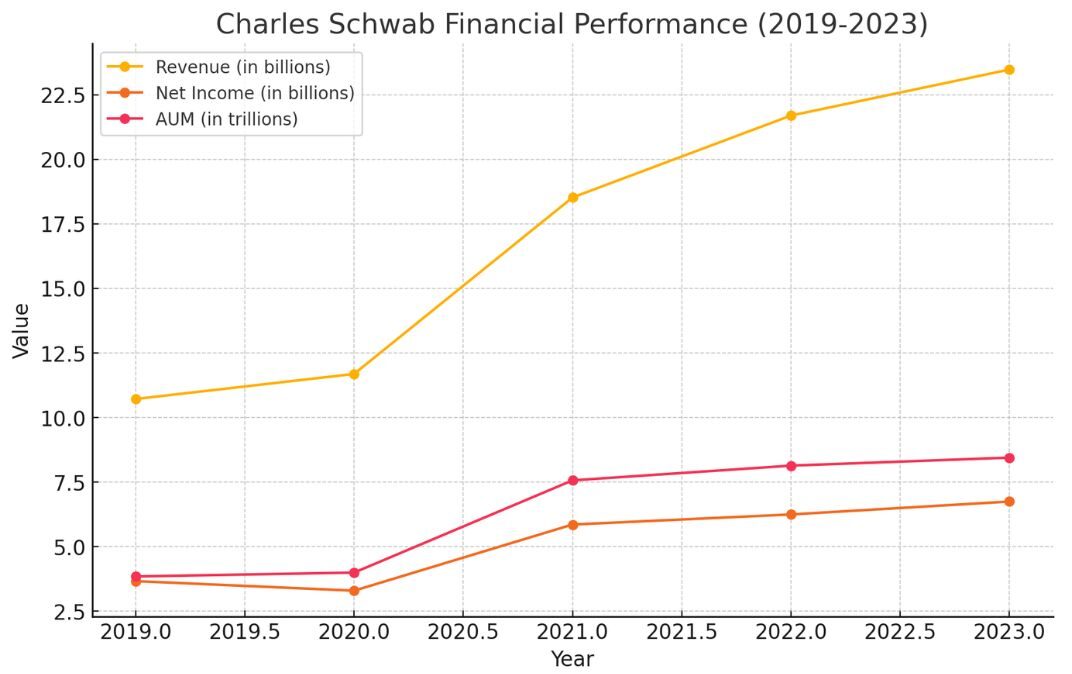

Financial Performance

Charles Schwab has consistently posted strong financial results, with significant growth in revenue and assets under management (AUM). The table below highlights the company’s financial performance over the past five years:

| Year | Revenue (in billions) | Net Income (in billions) | AUM (in trillions) |

|---|---|---|---|

| 2019 | 10.72 | 3.67 | 3.85 |

| 2020 | 11.69 | 3.30 | 4.00 |

| 2021 | 18.52 | 5.86 | 7.57 |

| 2022 | 21.69 | 6.25 | 8.14 |

| 2023 | 23.47 | 6.75 | 8.45 |

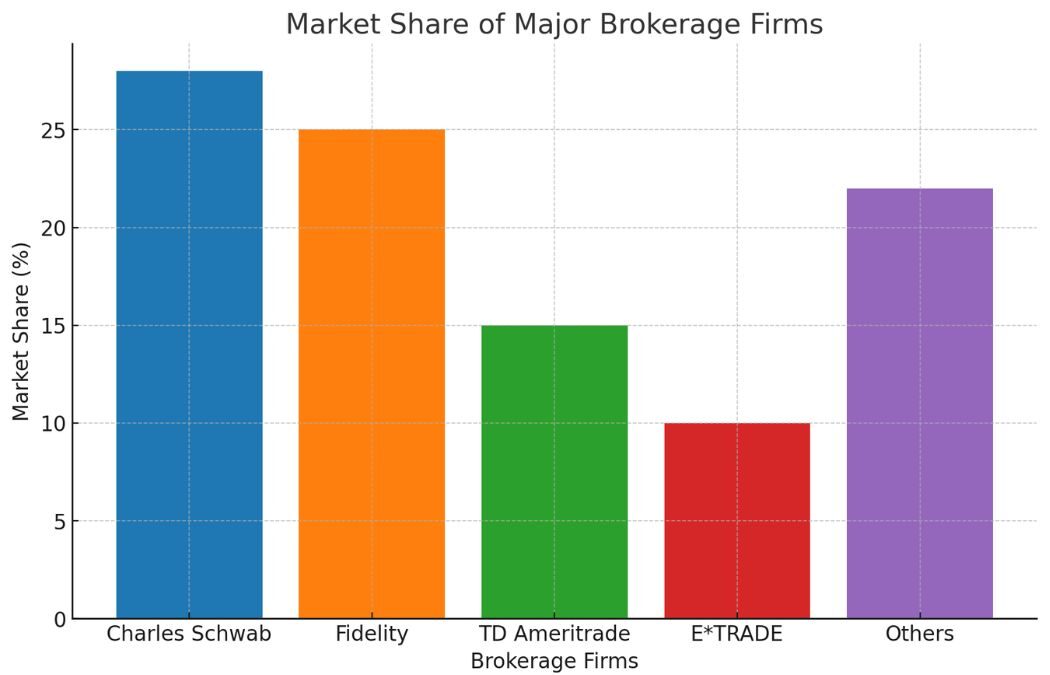

Market Position

Charles Schwab is a dominant player in the financial sector, boasting a significant market share. The company’s innovative solutions and customer-focused strategies have positioned it as a leader in the brokerage industry.

Details of the Schwab Layoffs

Reasons for the Layoffs

The primary reasons behind the Schwab layoffs include:

- Cost Reduction: In an effort to streamline operations and reduce costs, Schwab has decided to downsize its workforce.

- Integration with TD Ameritrade: Following the acquisition of TD Ameritrade, Schwab is restructuring to eliminate redundancies.

- Technological Advancements: Increased automation and digitalization have reduced the need for certain roles.

Number of Employees Affected

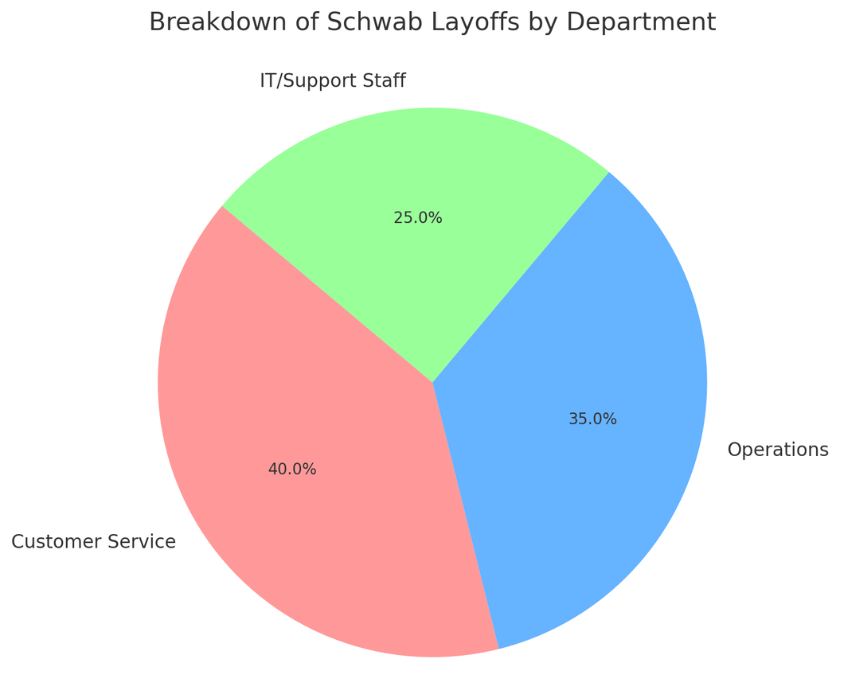

Schwab announced that approximately 1,000 employees, representing about 3% of its workforce, would be laid off. The layoffs are spread across various departments, with a focus on those areas where redundancies were identified post the TD Ameritrade integration.

Departments Impacted

The layoffs primarily affect the following departments:

- Customer Service: Due to increased automation.

- Operations: Streamlining processes post-merger.

- IT and Support Staff: Redundant roles due to technological upgrades.

Economic Impact of Schwab Layoffs

a) Effects on Employees

The immediate impact of the layoffs is felt by the employees who lose their jobs. These individuals face financial uncertainty and the challenge of finding new employment in a competitive market.

b) Effects on the Local Economy

The layoffs also have a ripple effect on the local economies where Schwab offices are located. Reduced consumer spending by laid-off employees can affect local businesses and services.

c) Broader Economic Implications

On a larger scale, the Schwab layoffs reflect broader trends in the financial industry, such as consolidation and increased automation. These trends may lead to further job losses and shifts in employment patterns within the sector.

Case Studies and Examples

Similar Layoffs in the Financial Industry

- Morgan Stanley: In 2020, Morgan Stanley laid off approximately 1,500 employees as part of a cost-cutting initiative.

- Goldman Sachs: In 2023, Goldman Sachs announced layoffs affecting around 3,200 employees due to restructuring and cost management.

Lessons from Past Layoffs

Historical data suggests that while layoffs can provide short-term financial relief for companies, they can also lead to long-term challenges such as reduced employee morale and potential talent shortages.

Investor Reaction and Market Response

1) Stock Performance Post-Layoffs

Following the announcement of the layoffs, Charles Schwab’s stock experienced a mixed reaction. Initially, the stock saw a slight uptick as investors responded positively to the cost-cutting measures. However, concerns about the long-term impact led to some volatility.

2) Analyst Opinions

Analysts have offered varied opinions on Schwab’s decision. Some view it as a necessary step for long-term sustainability, while others express concerns about the potential negative effects on the company’s culture and customer service quality.

Future Outlook for Charles Schwab

Strategic Moves

Looking ahead, Schwab is expected to focus on the following strategic areas:

- Enhancing Digital Services: Continued investment in technology to improve customer experience.

- Expanding Market Reach: Targeting new customer segments and markets.

- Sustainable Growth: Balancing cost management with growth initiatives.

Long-term Prospects

Despite the layoffs, Charles Schwab remains well-positioned for future growth. The company’s strong financial foundation and strategic initiatives suggest a positive long-term outlook.

Conclusion

The Schwab layoffs are a significant event with wide-reaching implications. While they represent a challenging period for the company and its employees, they also highlight broader trends and shifts within the financial industry. By understanding the reasons behind these layoffs and their impact, stakeholders can better navigate the evolving landscape of the financial sector.

Blue Techker I appreciate you sharing this blog post. Thanks Again. Cool.