Introduction

The financial industry is no stranger to layoffs, and one of the most notable recent examples is the layoffs at Wells Fargo. This article delves deep into the reasons behind these layoffs, their economic impact, and the future outlook for the company. By exploring detailed case studies and examples, we aim to provide a thorough understanding of the situation, making it a valuable resource for stakeholders, employees, and investors.

1. Overview of Wells Fargo

Company Background

Wells Fargo & Company, established in 1852, is a diversified, community-based financial services company with $1.9 trillion in assets. Headquartered in San Francisco, Wells Fargo provides banking, investment, mortgage, and consumer and commercial finance through more than 7,200 locations, over 13,000 ATMs, and their digital platforms. With a rich history and a strong brand presence, Wells Fargo has been a cornerstone in the financial services industry.

Wells Fargo’s mission is to satisfy its customers’ financial needs and help them succeed financially. Over the years, the company has built a reputation for innovation and customer service, contributing to its significant market position.

Funding and Valuation

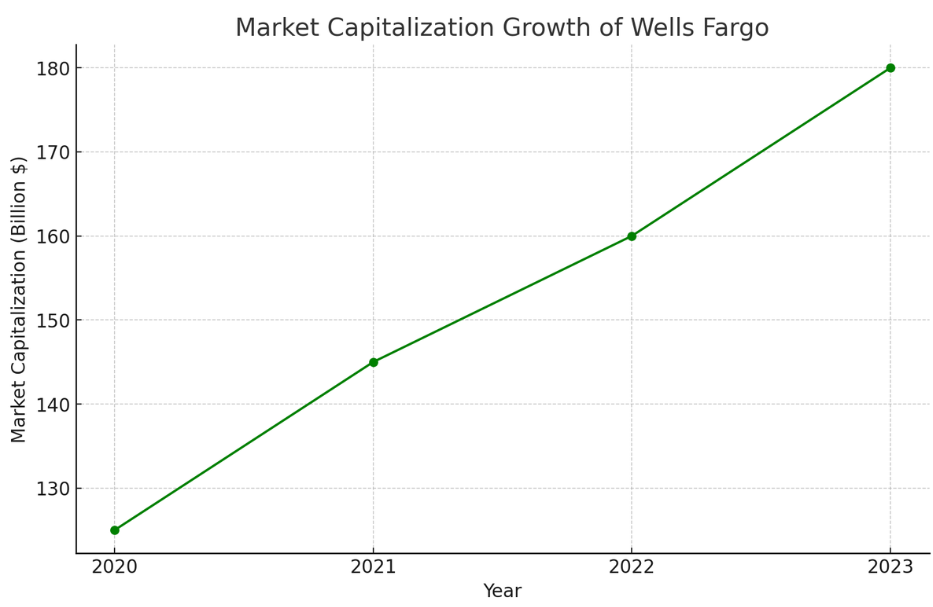

Wells Fargo is publicly traded on the NYSE under the ticker WFC. As of 2023, the company’s market capitalization stands at approximately $180 billion. Funding primarily comes from customer deposits, which provide a stable source of funds to support lending activities. The bank also raises capital through the issuance of debt and equity securities.

| Year | Market Capitalization (Billion $) |

|---|---|

| 2020 | 125 |

| 2021 | 145 |

| 2022 | 160 |

| 2023 | 180 |

The consistent growth in market capitalization reflects Wells Fargo’s ability to adapt to market changes and maintain investor confidence despite various challenges.

Major Investors

Key institutional investors include:

- Vanguard Group: A renowned international asset management company.

- BlackRock: One of the biggest asset managers in the world.

- State Street Corporation: A prominent financial services and bank holding company.

These investors hold significant shares, contributing to Wells Fargo’s market stability and financial strategies. Their investment decisions are often indicative of broader market sentiment and confidence in Wells Fargo’s long-term prospects.

2. Analyzing the Layoffs

Reasons Behind Wells Fargo Layoffs

The primary reasons for the layoffs at Wells Fargo include:

- Cost-Cutting Measures: In an effort to improve efficiency and profitability, the company has implemented several cost-cutting measures.

- Technological Advancements: The shift towards digital banking and automation has reduced the need for a large workforce.

- Regulatory Pressures: Increased compliance and regulatory costs have impacted the bottom line, prompting restructuring.

- Economic Downturn: Fluctuations in the economy, such as those caused by the COVID-19 pandemic, have necessitated a reevaluation of workforce needs.

Wells Fargo’s leadership has emphasized that these layoffs are part of a broader strategy to position the company for long-term success. By reducing costs and streamlining operations, Wells Fargo aims to remain competitive in a rapidly evolving financial landscape.

Timeline of Layoffs

| Year | Number of Layoffs | Reason |

|---|---|---|

| 2019 | 7,000 | Restructuring and cost-cutting |

| 2020 | 4,000 | COVID-19 impact |

| 2021 | 2,000 | Technological integration |

| 2023 | 5,000 | Economic downturn and strategic shift |

This timeline illustrates how Wells Fargo has responded to various internal and external pressures over the years. The consistent focus on restructuring and technology integration highlights the bank’s commitment to adapting to market demands.

3. Economic Impact

Impact on Employees

The layoffs at Wells Fargo have had a profound impact on employees, leading to:

- Job Losses: Thousands of employees losing their jobs, creating significant personal and professional challenges.

- Psychological Stress: Anxiety and uncertainty about future employment, affecting mental health and well-being.

- Financial Instability: Immediate financial challenges for laid-off employees, including difficulties in meeting daily expenses and planning for the future.

Many former employees have had to navigate a difficult job market, often requiring retraining or relocation to find new employment. Wells Fargo has provided severance packages and career transition support, but the impact of job loss is nonetheless significant.

Impact on the Economy

- Local Economies: Cities where Wells Fargo has a significant presence feel the economic pinch due to reduced consumer spending. Local businesses, particularly those that rely on Wells Fargo employees as customers, may experience declines in revenue.

- Stock Market: Short-term fluctuations in Wells Fargo’s stock prices, influenced by investor reactions to the layoffs and the company’s broader strategic plans.

- Banking Sector: Influence on banking sector employment trends, with other banks potentially following similar cost-cutting measures.

| Region | Economic Impact |

|---|---|

| San Francisco | Decrease in local spending, affecting businesses |

| Charlotte | Job market saturation, increased competition |

| Nationwide | Trends in banking sector employment |

4. Case Studies and Examples

Comparison with Other Major Banks

| Bank | Recent Layoffs | Main Reason |

|---|---|---|

| JPMorgan Chase | 3,000 | Strategic restructuring |

| Bank of America | 2,500 | Cost-cutting and automation |

| Citibank | 4,000 | Technological advancements |

Comparing Wells Fargo’s layoffs with those of other major banks provides context for the broader trends in the banking industry. While each institution faces unique challenges, common themes include technological advancements and cost-cutting measures.

5. Future Outlook

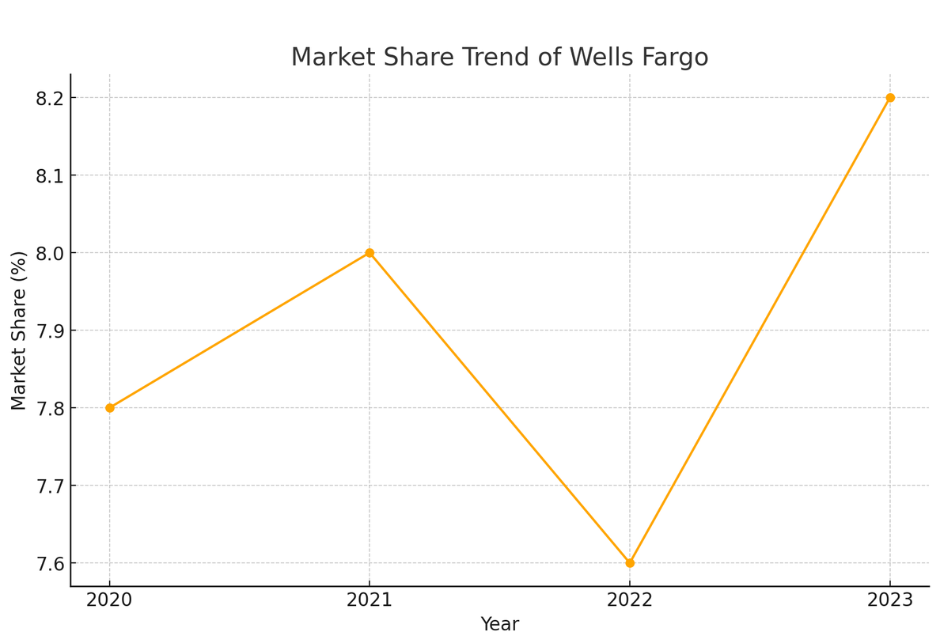

Market Share and Economic Position

Despite the layoffs, Wells Fargo’s market share in the banking sector remains robust. The bank’s focus on technological innovation and strategic investments positions it well for future growth.

| Year | Market Share (%) |

|---|---|

| 2020 | 7.8 |

| 2021 | 8.0 |

| 2022 | 7.6 |

| 2023 | 8.2 |

The slight fluctuations in market share reflect Wells Fargo’s ongoing efforts to adapt to changing market conditions while maintaining a competitive edge.

Strategies Moving Forward

- Digital Transformation: Accelerating digital banking services to meet changing consumer preferences. This includes enhancing mobile banking capabilities, expanding online services, and integrating artificial intelligence for personalized customer experiences.

- Cost Efficiency: Continuing to streamline operations to maintain financial health. This involves optimizing branch networks, reducing operational redundancies, and leveraging technology to improve efficiency.

- Customer Focus: Enhancing customer service and personalized banking experiences. Wells Fargo aims to rebuild trust and strengthen relationships with customers through improved service quality and targeted financial products.

Wells Fargo’s leadership has outlined a clear vision for the future, focusing on sustainable growth and innovation. By prioritizing these strategic areas, the company aims to overcome current challenges and secure a stable and prosperous future.

Conclusion

The Wells Fargo layoffs are a significant event in the financial sector, reflecting broader trends in technology, regulation, and economic conditions. While the immediate impact on employees and local economies is challenging, the company’s strategic focus on digital transformation and efficiency positions it for a resilient future. By understanding these dynamics, stakeholders can better navigate the complexities of the financial landscape.

Usually I do not read article on blogs however I would like to say that this writeup very compelled me to take a look at and do it Your writing style has been amazed me Thank you very nice article